How Much Money Does Michael Jackson Have?

How Much Money Does Michael, a ubiquitous phrase in modern parlance, refers to a noun inquiring about the amount of money possessed by an individual named Michael. For instance, a businessman might ponder, "How Much Money Does Michael Jackson have?" This phrase holds immense practical value, aiding financial planning, investment decisions, and informed negotiations. It has evolved with technological advancements, enabling instant access to financial data.

Uncovering How Much Money Does Michael offers invaluable insights into an individual's financial standing. It facilitates informed decision-making, allowing individuals to assess their own financial situation and make appropriate adjustments. Moreover, this phrase has been instrumental in shaping economic policies and regulations, ensuring financial transparency and accountability.

This article delves into the intricacies of How Much Money Does Michael, exploring its fundamental principles, underlying factors, and practical applications. It will provide a comprehensive understanding of this crucial financial metric, empowering readers to make informed choices and navigate the complexities of personal finance.

How Much Money Does Michael

Exploring the essential aspects of "How Much Money Does Michael" is paramount to gaining a comprehensive understanding of personal finance and wealth management. These aspects encompass various dimensions, providing a holistic view of an individual's financial situation.

- Income

- Assets

- Investments

- Savings

- Debts

- Expenses

- Net Worth

- Financial Goals

- Tax Implications

By examining these aspects, individuals can assess their financial health, identify areas for improvement, and make informed decisions to achieve their financial objectives. Understanding income sources, managing expenses effectively, and investing wisely are crucial for accumulating wealth and securing financial well-being. Furthermore, considering tax implications, planning for financial goals, and addressing debts responsibly are essential aspects of sound financial management.

| Name | Birth | Death | Occupation | Net Worth |

|---|---|---|---|---|

| Michael Joseph Jackson | August 29, 1958 | June 25, 2009 | Singer, songwriter, dancer, record producer | $500 million |

Income

Income serves as the foundation for understanding How Much Money Does Michael possess. It represents the inflow of funds from various sources, such as wages, salaries, bonuses, commissions, dividends, interest, and business profits. Income is a critical component of personal finance, as it determines an individual's purchasing power, savings potential, and overall financial well-being.

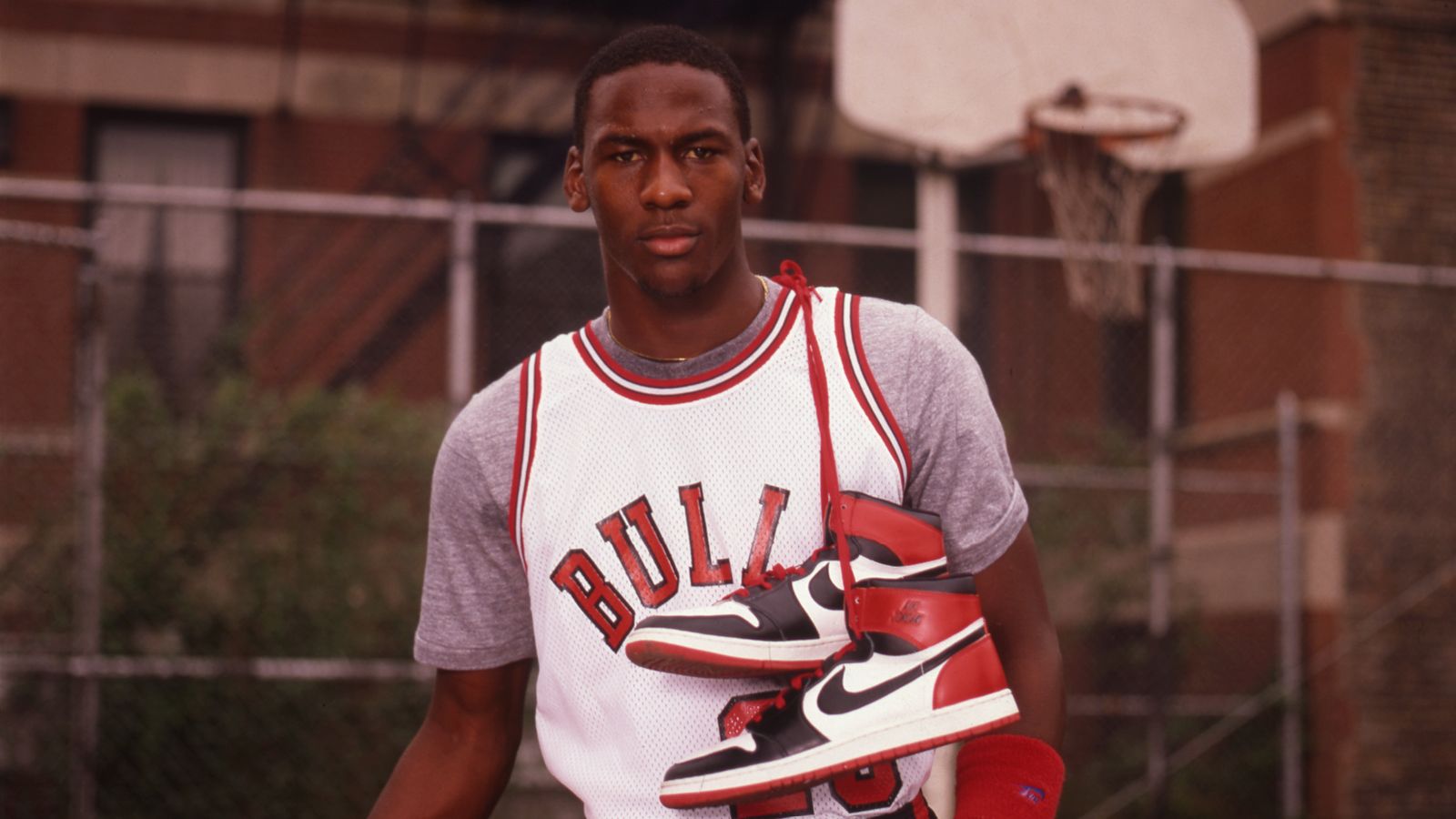

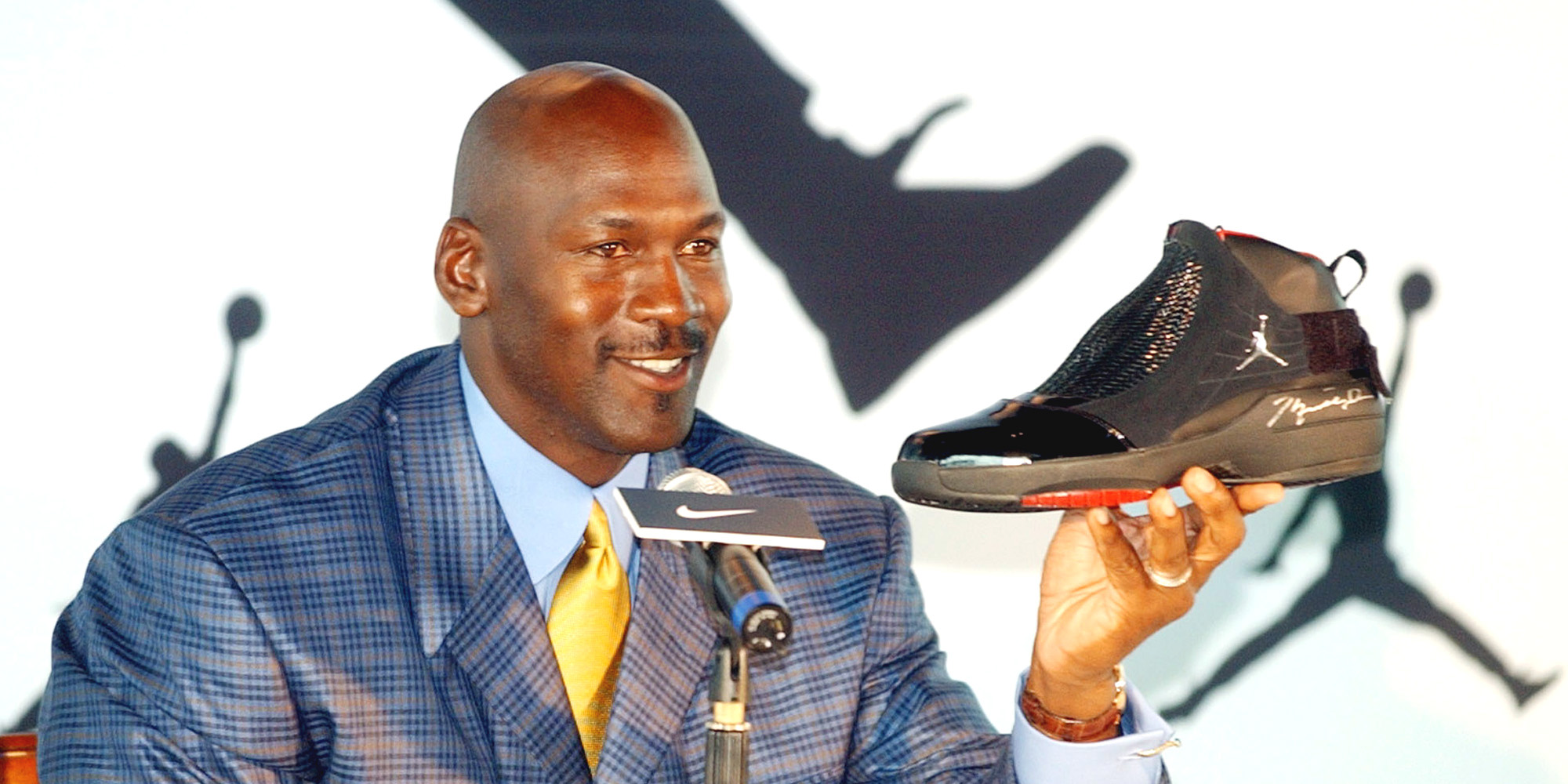

In the case of Michael Jackson, his income was primarily derived from his music career. As a renowned singer, songwriter, and performer, he generated substantial earnings through album sales, concert tours, endorsements, and other ventures. Jackson's high income enabled him to acquire a vast fortune, invest in various assets, and support a lavish lifestyle.

Understanding the relationship between income and How Much Money Does Michael is crucial for financial planning and wealth management. By analyzing income streams, individuals can assess their financial situation, set financial goals, and make informed decisions to increase their income and accumulate wealth. Moreover, understanding income sources and their stability is essential for managing expenses, planning for retirement, and making informed investment choices.

Assets

Assets play a pivotal role in determining How Much Money Does Michael possess. They represent the resources or items of value that an individual owns, which can be converted into cash or used to generate income. Assets are crucial for building wealth and ensuring financial security, as they serve as a store of value and provide potential for appreciation over time.

In the case of Michael Jackson, his assets included various forms of wealth, such as real estate, stocks, bonds, intellectual property, and collectibles. Jackson's ownership of the iconic Neverland Ranch, his extensive music catalog, and valuable artwork contributed significantly to his overall net worth. By acquiring and managing these assets, Jackson was able to accumulate substantial wealth and secure his financial future.

Understanding the connection between assets and How Much Money Does Michael is essential for effective financial planning and wealth management. By identifying, valuing, and managing assets strategically, individuals can increase their net worth and achieve their financial goals. Assets provide a foundation for financial stability, serve as a source of income generation, and offer potential for growth and appreciation.

In conclusion, Assets are a critical component of How Much Money Does Michael, as they represent the tangible and intangible resources that contribute to an individual's overall wealth. By understanding the relationship between assets and net worth, individuals can make informed decisions about acquiring, managing, and leveraging assets to achieve their financial objectives.

Investments

Investments serve as a crucial component of How Much Money Does Michael, as they represent the allocation of funds with the primary goal of generating income or capital appreciation. Investments enable individuals to grow their wealth, preserve the value of their assets, and achieve their long-term financial objectives.

Investments play a vital role in determining How Much Money Does Michael possess. By investing in stocks, bonds, real estate, and other financial instruments, individuals can potentially increase their net worth over time. Investments offer the potential for capital appreciation, dividend income, and interest payments, which can significantly contribute to an individual's overall financial well-being.

Real-life examples of Investments within How Much Money Does Michael include:

- Michael Jackson's investment in the Sony/ATV Music Publishing catalog

- Jackson's acquisition of the iconic Neverland Ranch property

- Jackson's involvement in various business ventures, such as film production and merchandise

Understanding the connection between Investments and How Much Money Does Michael is essential for informed financial planning and wealth management. By making strategic investment decisions, individuals can potentially increase their income, grow their wealth, and secure their financial future. Investments provide a means to diversify portfolios, manage risk, and achieve financial goals.

Savings

Within the realm of "How Much Money Does Michael," Savings holds a pivotal position as a crucial aspect of financial planning and wealth management. Savings represent the portion of income set aside for future use, serving as a financial cushion and a means to achieve long-term financial goals.

- Emergency Fund: A readily accessible pool of money designated for unexpected expenses or financial emergencies, providing a safety net against unforeseen circumstances.

- Retirement Savings: Funds earmarked for the post-employment years, typically invested in retirement accounts such as 401(k)s or IRAs, ensuring financial security during retirement.

- Short-Term Savings: Funds set aside for specific, near-term goals, such as a down payment on a house or a new car, providing a means to make larger purchases without incurring debt.

- Long-Term Savings: Funds intended for long-term financial objectives, such as a child's education or a comfortable retirement, typically invested in a diversified portfolio of stocks, bonds, and other assets.

Understanding the multifaceted nature of Savings is crucial in determining "How Much Money Does Michael" possess. By examining savings habits, individuals can assess their financial preparedness, plan for the future, and make informed decisions about their financial goals. Savings provide a foundation for financial stability, offering peace of mind, flexibility, and the ability to seize opportunities as they arise.

Debts

Debts are an integral component of "How Much Money Does Michael," representing borrowed funds that must be repaid with interest. Understanding the connection between debts and financial standing is crucial for effective financial management and wealth accumulation. Debts can significantly impact an individual's financial well-being, affecting their ability to save, invest, and achieve long-term financial goals.

Individuals may incur debts for various reasons, such as purchasing a home, financing a car, or consolidating high-interest debts. While debts can provide access to necessary resources or financial leverage, it's essential to manage them responsibly to avoid negative consequences. High levels of debt can strain an individual's budget, limit their financial flexibility, and damage their credit score. Therefore, it's crucial to carefully consider the purpose, terms, and potential risks associated with any debt before taking it on.

Real-life examples of "Debts" within "How Much Money Does Michael" include mortgages, personal loans, credit card balances, and business loans. Managing these debts effectively requires a disciplined approach to budgeting, debt repayment, and financial planning. Individuals can utilize debt consolidation strategies, negotiate lower interest rates, and seek professional financial advice to optimize their debt management and improve their overall financial situation.

Understanding the connection between "Debts" and "How Much Money Does Michael" empowers individuals to make informed financial decisions. By assessing their debt obligations, individuals can develop realistic financial plans, prioritize debt repayment, and avoid the pitfalls of excessive debt. Responsible debt management is essential for achieving financial stability, building wealth, and securing a sound financial future.

Expenses

In the realm of "How Much Money Does Michael," Expenses play a pivotal role, representing the outflow of funds used to pay for goods and services consumed. Understanding the connection between expenses and financial standing is essential for effective financial management and wealth accumulation. Expenses can significantly impact an individual's financial well-being, affecting their ability to save, invest, and achieve long-term financial goals.

Individuals incur expenses for various reasons, such as housing, transportation, food, healthcare, entertainment, and personal care. While some expenses are essential for maintaining a certain standard of living, others may be discretionary and can be adjusted to align with financial goals. Tracking and categorizing expenses allows individuals to identify areas where spending can be optimized or reduced, leading to increased savings and potential for wealth accumulation.

Real-life examples of "Expenses" within "How Much Money Does Michael" include rent or mortgage payments, utility bills, groceries, fuel costs, and entertainment expenses. Managing these expenses effectively requires a disciplined approach to budgeting and financial planning. Individuals can utilize expense tracking apps, create spending plans, and seek professional financial advice to optimize their expense management and improve their overall financial situation.

Understanding the connection between "Expenses" and "How Much Money Does Michael" empowers individuals to make informed financial decisions. By assessing their spending patterns, individuals can develop realistic financial plans, prioritize essential expenses, and reduce unnecessary expenditures. Responsible expense management is crucial for achieving financial stability, building wealth, and securing a sound financial future.

Net Worth

Within the realm of "How Much Money Does Michael," "Net Worth" stands as a critical indicator of an individual's overall financial well-being. Net Worth represents the difference between an individual's total assets and total liabilities, providing a snapshot of their financial position at a specific point in time. Understanding the connection between Net Worth and "How Much Money Does Michael" is crucial for assessing financial health and making informed financial decisions.

Net Worth serves as a comprehensive measure of an individual's financial standing, capturing not only their current income and expenses but also their long-term financial trajectory. A high Net Worth typically indicates a strong financial position, characterized by a substantial accumulation of assets and effective management of debts. Conversely, a low or negative Net Worth may suggest financial challenges or the need for financial planning and debt reduction strategies.

Real-life examples of Net Worth within "How Much Money Does Michael" can be observed in the financial profiles of high-profile individuals such as celebrities, business tycoons, and investors. By analyzing their publicly available financial statements or estimated Net Worth figures, we can gain insights into their overall financial health and the factors contributing to their wealth accumulation. Understanding the drivers of Net Worth, such as income, investments, assets, and liabilities, provides valuable lessons for individuals seeking to improve their own financial well-being.

The practical applications of understanding the connection between Net Worth and "How Much Money Does Michael" are multifaceted. For individuals, it serves as a benchmark for financial progress and a basis for setting realistic financial goals. By tracking their Net Worth over time, individuals can identify areas for improvement, make informed investment decisions, and plan for long-term financial security. For investors, understanding Net Worth is crucial for evaluating potential investment opportunities and assessing the financial health of companies and individuals.

In conclusion, Net Worth plays a pivotal role in determining "How Much Money Does Michael" by providing a comprehensive measure of an individual's financial position. Understanding the connection between these two concepts is essential for assessing financial health, making informed financial decisions, and achieving long-term financial well-being. By analyzing Net Worth and its components, individuals can gain valuable insights into their financial trajectory and take proactive steps to improve their financial future.

Financial Goals

Understanding an individual's "Financial Goals" is an integral aspect of determining "How Much Money Does Michael" possess. Financial Goals represent the specific objectives and aspirations that individuals set for themselves in relation to their finances. These goals serve as guiding principles for financial planning and decision-making, providing direction and motivation to accumulate wealth and secure financial well-being.

- Retirement Planning: Preparing for financial security during retirement involves setting goals for saving, investing, and managing assets to ensure a comfortable and financially independent post-employment life.

- Wealth Accumulation: Building long-term wealth requires setting goals for increasing income, minimizing expenses, and making strategic investments to grow assets and achieve financial abundance.

- Financial Independence: Achieving financial independence involves setting goals for generating passive income or creating a business that allows individuals to live on their own terms, free from the constraints of traditional employment.

- Debt Management: Setting goals for reducing debt, whether it's credit card balances, student loans, or mortgages, helps individuals improve their financial health, reduce interest expenses, and enhance their overall financial standing.

By defining and aligning their Financial Goals with their overall financial situation, individuals can create a roadmap for achieving their desired financial outcomes. The connection between Financial Goals and "How Much Money Does Michael" is crucial, as it provides a framework for assessing whether an individual's financial resources are sufficient to meet their long-term aspirations. Understanding the interplay between these two concepts empowers individuals to make informed financial decisions, prioritize their goals, and ultimately achieve financial success.

Tax Implications

Within the context of "How Much Money Does Michael," it is crucial to consider the aspect of "Tax Implications." This refers to the legal and financial obligations individuals have to pay taxes on their income, assets, and business activities. Understanding the various facets and implications of tax implications can significantly impact financial planning, decision-making, and wealth accumulation.

- Taxable Income: The portion of an individual's income subject to taxation, determined by deducting eligible expenses and allowances from gross income. Understanding taxable income is essential for accurate tax calculations and minimizing tax liability. For instance, Michael Jackson's taxable income would include earnings from music sales, endorsements, and other revenue-generating activities.

- Tax Rates: The percentage of taxable income that must be paid in taxes. Tax rates can vary depending on income levels, filing status, and other factors. Michael Jackson, with his substantial income, would likely fall into a higher tax bracket, resulting in a higher tax rate.

- Tax Deductions: Expenses and allowances that can be subtracted from gross income to reduce taxable income. Deductions can include business expenses, charitable contributions, and certain personal expenses. Michael Jackson could utilize deductions related to music production costs, travel expenses, and philanthropic donations.

- Tax Credits: Direct reductions in the amount of taxes owed, rather than deductions from income. Tax credits can provide significant tax savings and encourage certain behaviors or investments. For example, Michael Jackson may have qualified for tax credits related to renewable energy initiatives or historic preservation.

Comprehending the tax implications associated with "How Much Money Does Michael" is paramount for optimizing financial strategies and ensuring compliance with tax laws. By considering taxable income, tax rates, deductions, and credits, individuals can effectively manage their tax liability, maximize their after-tax income, and make informed financial decisions that align with their long-term financial goals.

In conclusion, delving into the intricacies of "How Much Money Does Michael" has illuminated the multifaceted nature of personal finance and wealth management. Understanding the fundamental aspects of income, assets, investments, savings, debts, expenses, net worth, financial goals, and tax implications provides a comprehensive framework for assessing an individual's financial well-being and making informed financial decisions.

Key takeaways from this exploration include the importance of managing cash flow effectively, diversifying investments wisely, setting realistic financial goals, and considering tax implications when making financial decisions. These elements are interconnected and interdependent, and a holistic approach is crucial for achieving long-term financial success.

The enduring significance of understanding "How Much Money Does Michael" lies in its ability to empower individuals to take control of their financial lives, plan for the future, and make informed choices that align with their financial goals. Whether it's saving for retirement, building wealth, or managing debt, understanding these concepts provides a solid foundation for financial literacy and long-term financial well-being.What You Need To Know About Peter Thiel's Investments

How To Calculate Kathy Lennon's Net Worth: A Comprehensive Guide

Sarah Snyder And Eileen Kelly: Two Pioneers In Nursing

ncG1vNJzZmikmayyr7PKnmWsa16qwG7DxKyrZmpelrqixs6nmLCrXpi8rnvHqK5mpaWYtW65zqecsmWUpLK0ecyimqGZlaF7qcDMpQ%3D%3D